Experian will provide a copy of your credit report under its statutory obligations for a cost of £2. This means that to obtain your experience credit report you do not need to sign up for an account on any subscription basis, free or otherwise.

Below we outline how the process of obtaining your Experian Statutory Credit Report works.

Search

Use your browser to search for ‘Experian Statutory Credit Report’. This should bring up a link to the correct page in the search engine results. That link looks like this (below). Do not click the ads at the top of the engine results as they are trying to sell you something.

Order

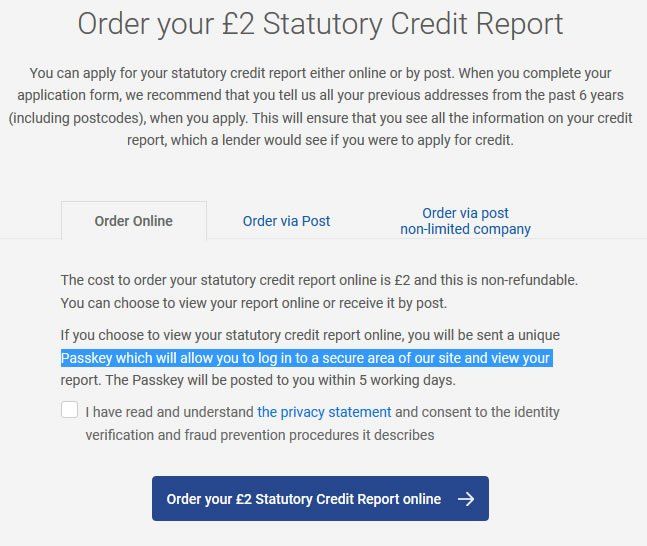

Use the ‘order now’ button which will take you to the terms, read the privacy statement, and click the link which says ‘Order your £2 Statutory Credit report Online’.

Request

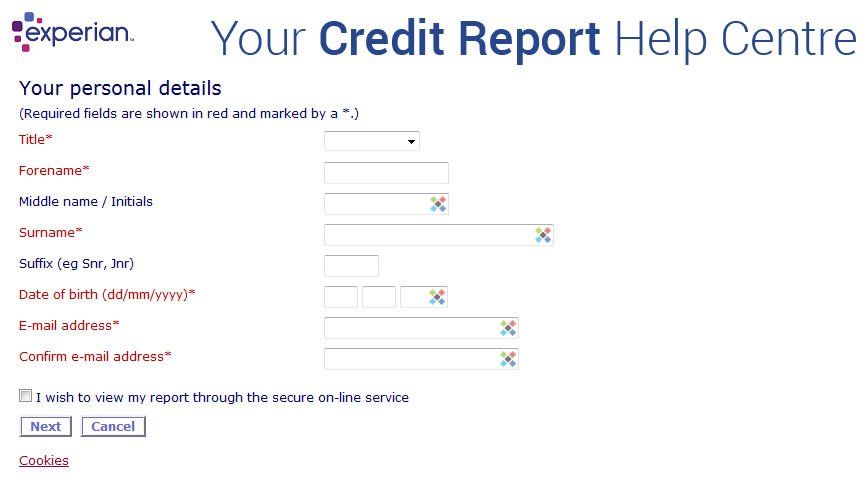

Complete the order form which requests details that you will know off the top of your head.

Log on

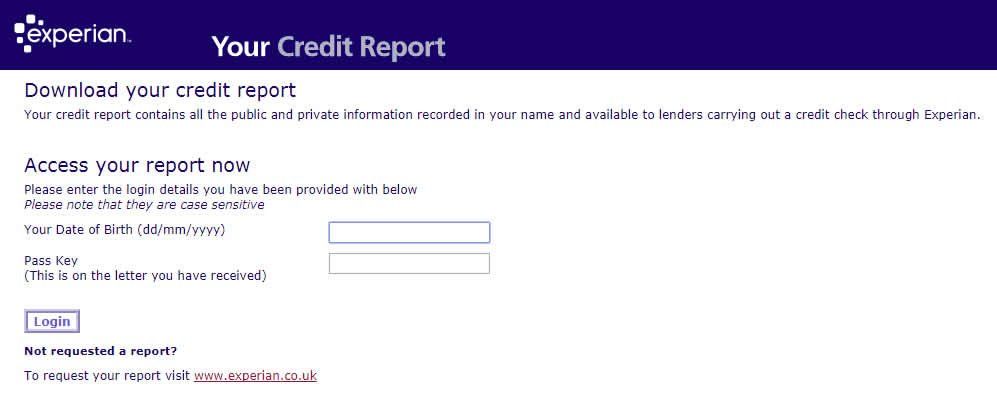

The correct login page is set out as below. Use your details to log in.

Download

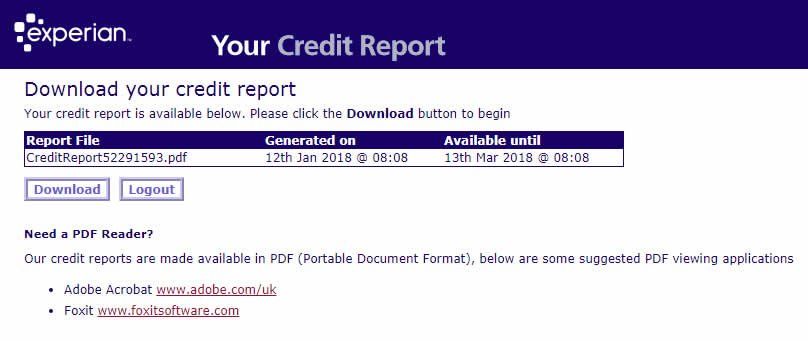

The login takes you to a simple download page, from here you can easily download your full Experian Statutory Credit Report.

Notes

Provide this full credit report to your mortgage broker to enable them to assess your mortgage options. There are a few points to note:

Do not email your credit report. Emails are not secure, and you don’t want your credit report in the wrong hands.

Here at A Mortgage Now we have a secure upload link that you can use to provide us with your credit report.

Upload

To upload your credit file to us.

*on Mozilla Firefox or Google Chrome browsers the initial process is the same, but the actions for the final file save differ slightly. Both the Firefox and the Chrome browser have their save links on the right of the top toolbar in the browser.

Uploading your credit file to A Mortgage Now

Go to amortgagenow.wetransfer.com

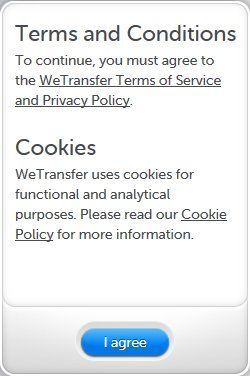

Read the terms and click the ‘I agree’ button to agree to the site terms before use. You can then see the upload fields.

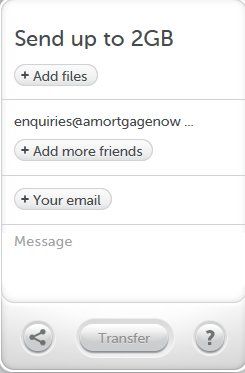

Use the + Add files section to navigate to your newly saved credit file and select it.

Our notification receipt address of enquiries@amortgagenow.co.uk is already completed in the ‘Add more friends section’.

Enter ‘Your email’ (the one you used when you enquired to us initially). You will then receive an acknowledgement email once our team has securely downloaded your file.

You may wish to add information for us in the ‘Message’ section before clicking the ‘Transfer’ button.

If you have saved your credit file on a shared computer, we suggest you permanently delete the file after use.

Credit reports are published by three main providers in the UK; Experian, Equifax, and Call Credit (Noddle). There will be circumstances where your mortgage broker may ask for copies of all three reports from all three companies. This is because the data on the three reports can vary, and different mortgage lenders refer to different credit report providers.

If we here at A Mortgage Now specifically ask you for an Experian report, you do not need to provide the other reports unless we later specifically request them.

The early pages of your credit report show ‘Your Experian Credit Score’, which is a score out of 999, and these are rated by Experian, for example, ‘Excellent’, ‘Good’, ‘Poor’, ‘Very Poor’. Please note that these ratings are simply a marketing tactic by the credit report providers. The mortgage lender does not make any decision based on the credit provider’s opinion of your credit file.